52 Shades of Wealth

TEEN EDITION

A Financial Literacy Challenge and Journal Designed for Your Teen's Financial Journey

Are you ready to empower your teen with essential financial skills that will last a lifetime? "52 Shades of Wealth: Teens Edition" is here to guide them through the exciting world of money management, budgeting, and wealth-building.

52 Shades of Wealth

EASY & READY TO USE WEALTH MINDSET JOURNAL

Take The Challenge

Here's what your teen will gain from this transformative journal:

Here's what your teen will gain from this transformative journal:

Here's what your teen will gain from this transformative journal:

Earning Money: Teach your teen the importance of earning money through part-time jobs, allowances, or entrepreneurial ventures, setting them on the path to financial independence from a young age.

Budgeting Basics: Introduce the concept of budgeting to help your teen manage their income effectively, prioritize spending, and cultivate responsible financial habits.

Saving for Short-Term Goals: Encourage your teen to save for short-term goals like purchasing gadgets, clothes, or concert tickets, empowering them to achieve their dreams through smart financial planning.

Understanding Banking: Equip your teen with knowledge about different types of bank accounts, ATM usage, and basic banking principles, laying the foundation for a lifetime of financial literacy.

Credit and Debit Cards: Educate your teen about the responsible use of credit and debit cards, teaching them how to avoid debt and manage spending wisely in today's cashless society.

Setting Financial Goals: Help your teen set realistic financial goals for the future, such as saving for college or a car, and empower them to take control of their financial destiny.

Understanding Interest: Explain the concept of interest rates and how they affect savings and borrowing, ensuring your teen makes informed decisions when managing their finances.

Avoiding Impulse Buying: Teach your teen to resist impulse buying and make thoughtful purchasing decisions, empowering them to become savvy consumers in a world full of tempting distractions.

Participating in the Gig Economy: Introduce your teen to opportunities in the gig economy, such as freelance work or selling products online, opening doors to alternative income streams and entrepreneurial ventures.

Understanding Taxes: Provide your teen with a basic understanding of taxes and how they impact income and spending, preparing them for financial responsibilities as they enter adulthood.

Planning for College Expenses: Educate your teen about the costs associated with college and how to start saving for them, ensuring they are financially prepared for higher education.

Avoiding Financial Scams: Arm your teen with the knowledge to recognize and avoid common financial scams and frauds, protecting them from potential pitfalls in today's digital landscape.

Understanding Student Loans: Explain the basics of student loans, including interest rates and repayment options, empowering your teen to make informed decisions about higher education financing.

Investing Basics: Introduce your teen to the concept of investing in stocks, bonds, and mutual funds, laying the groundwork for building long-term wealth and financial security.

With "52 Shades of Wealth: Teens Edition," you're not just providing your teen with a journal—you're giving them the tools they need to thrive in today's complex financial landscape. Plus, with every purchase, you'll be making a difference in the lives of teens in marginalized communities by providing them with access to these invaluable resources.

Invest in your teen's future today with "52 Shades of Wealth: Teens Edition."

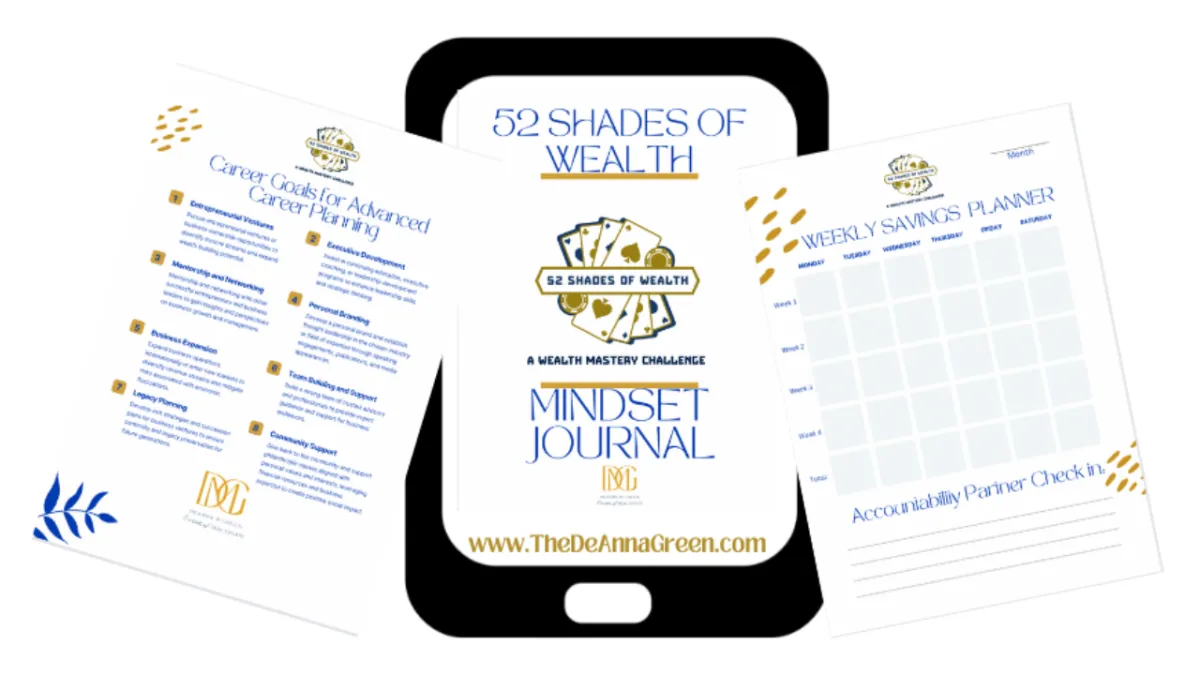

52 Shades of Wealth

Wealth Mindset Journal

BUY NOW to get these freebies in your inbox.

5Wealth Mindset Journal

BUY NOW $99.99 $69.99

Embark on a captivating journey of self-discovery with 52 Shades of Wealth,' the eagerly anticipated release by DeAnna Green.

Start Your Journey...Enroll Today!

BUY NOW $99.99- $69.99

Start Your Journey...

Enroll Today!

Will You Be Our Next Success Story?

Insight Without Action is Worthless!

Take Action Today!

866-845-3456 x700

Copyright © 2022 The DeAnnaGreen.com - All Rights Reserved.

Will You Be Our Next Success Story?

Insight Without Action is Worthless!

Take Action Today!

866-845-3456 x700

Copyright © 2022 The DeAnnaGreen.com

All Rights Reserved.